Post Office PPF The Public Provident Fund, commonly known as PPF, is one of the most trusted long-term savings schemes in India. It is backed by the government and designed for people who want safe and steady financial growth without high risk. Many families prefer PPF because it offers stable interest, tax benefits, and guaranteed returns over time. In 2026, interest in this scheme has increased again as people look for secure options to protect their savings from market uncertainty. Unlike risky investments, PPF focuses on patience and discipline, which makes it suitable for salaried employees, small business owners, and even young investors starting their financial journey.

Post Office PPF 2026 – Full Information Table

| Category | Details |

|---|---|

| Scheme Name | Public Provident Fund (PPF) |

| Investment Type | Long-Term Savings |

| Minimum Yearly Deposit | ₹500 |

| Example Investment | ₹50,000 per Year |

| Tenure | 15 Years (Extendable) |

| Risk Level | Very Low |

| Interest Benefit | Compounded Annually |

| Tax Advantage | Investment & Interest Usually Tax-Free |

| Withdrawal Facility | Partial After Specific Years |

| Best For | Retirement, Education, Long-Term Security |

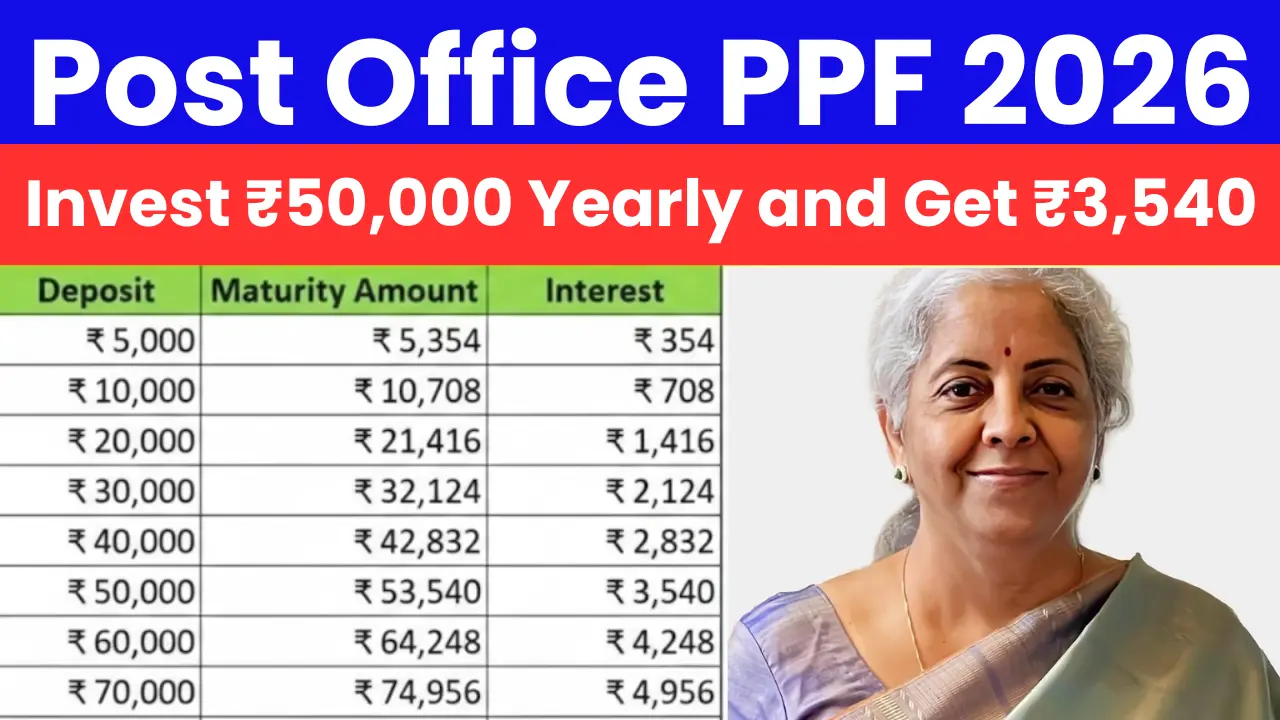

How Investing ₹50,000 Every Year Helps

Investing ₹50,000 per year may not seem like a huge amount at first, but consistency makes a big difference. PPF works on the principle of compounding, where interest is earned not only on the invested amount but also on previously earned interest. Over a long period, this compounding effect can turn small yearly deposits into a large fund. The scheme usually runs for 15 years, and investors also have the option to extend it further. By staying regular with deposits, individuals can build a financial cushion that can later help with retirement, children’s education, or emergency expenses. The strength of PPF lies in its long-term nature rather than quick profits.

Also Read

Safety and Stability of the Scheme

One of the biggest advantages of PPF is safety. Since it is supported by the government, the risk of losing money is extremely low compared to stocks or mutual funds. The interest rate may change slightly over time, but it generally remains stable and competitive. This stability attracts investors who prefer peace of mind over aggressive gains. People who do not want to track daily market movements or worry about sudden losses often choose PPF as their primary savings tool. It also encourages disciplined saving habits, which is important for long-term financial planning.

Tax Benefits and Financial Planning

Another major reason behind PPF’s popularity is its tax advantage. Investments made under this scheme are usually eligible for tax deductions, and the interest earned is also tax-free in most cases. This combination makes it attractive for middle-income families looking to reduce tax burden while growing their wealth. Financial planners often suggest PPF as a foundation for a balanced portfolio because it adds stability and predictable growth. Even if someone invests in other instruments like mutual funds or fixed deposits, PPF acts as a secure backup plan.

Flexibility and Withdrawal Options

Although PPF is a long-term scheme, it still provides limited flexibility. Partial withdrawals are allowed after a certain number of years, which helps investors manage urgent needs without closing the account. Loans can also be taken against the PPF balance during the early years. This feature makes the scheme practical because life situations can change, and access to funds becomes necessary. However, the true benefit is realized when investors keep the money invested for the full tenure, allowing compounding to work effectively.

Who Should Consider PPF in 2026

PPF is suitable for almost everyone who wants a secure financial future. Young professionals can start early and build a strong retirement base. Parents can invest for their children’s higher education plans. Self-employed individuals can use it as a disciplined savings channel since they may not have employer-provided retirement benefits. Even senior citizens sometimes extend their accounts for additional safety. The simplicity of opening and maintaining a PPF account through post offices or banks also adds to its convenience.